You wake up to another day from a great night’s sleep thinking your money is safe. You yawn and roll over to check your phone, and BOOM!!! You see a text from Cash App asking if a transaction is fraudulent. Of course, you select yes, and that’s when your whole world changes. It may not be immediate, but once you realize what has happened, you start going down that spiral… Yes, this spiral is one rabbit hole you want to avoid falling into.

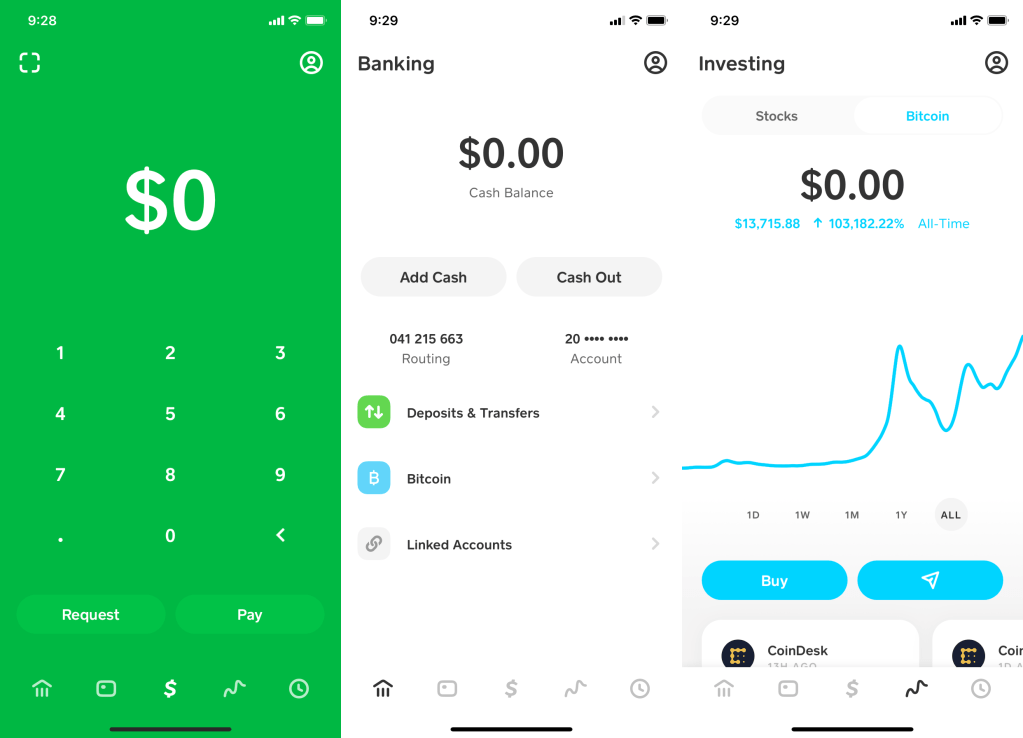

Mobile payment apps like Cash App have revolutionized how we transfer money, making it quick and convenient to split bills, pay for services, or send gifts with just a few taps. However, as the use of these apps grows, so does the risk of Fraud. Scammers are increasingly taking advantage of Cash App’s popularity to steal money from unsuspecting users and, more concerningly, gain access to their bank accounts. Often, these fraudsters don’t stop with a single victim—they target the victim’s contacts as well.

Unfortunately, with the convenience of apps like Cash App comes the increased risk of scams and hacking. I know someone who was personally affected when they were hacked through Cash App, a challenging experience they are unlikely to forget. Even though they were able to save their funds and prevent their money from being stolen, they were still targeted, and their money was still accessed without their knowing. The process of regaining their financial power was exhausting and emotionally draining.

Here’s what I learned from their experience, how events unfolded, and tips on how to protect yourself and your loved ones from becoming victims. Let’s explore how these scams work and what you can do to protect yourself and others. Remember, it is safe to use Zelle, Cash App, Google Pay, Apple Pay, Paypal, and Venmo; you just have to be careful with your accounts and your banking info.

The Anatomy of a Cash App Scam

The methods used by scammers are varied, but the goals remain the same: to gain access to your Cash App account, bank details, and contacts. Here’s a breakdown of how these scams generally unfold:

The Phishing Attack

Scammers often send fake emails, texts, or even social media messages that appear to be from Cash App. These messages usually include urgent-sounding language—perhaps a warning about suspicious activity on your account or a fake “verification” request. They will prompt you to click on a link and enter your login credentials or banking information.

Once they have your login details, the scammer can access your Cash App and linked bank accounts to steal your money. They may even lock you out of your account, changing your password and leaving you powerless to regain control.

Fake Customer Support

One of the most notorious Cash App scams involves fake customer support. Scammers set up bogus websites and phone numbers, claiming to offer support for users with app issues. When you call or visit these fake sites, the scammer may ask for personal details or trick you into downloading malicious software. This gives them access to your device and your Cash App account.

It’s important to note that Cash App does have a customer support phone number. Yet victims fall prey to fake texts from customer service (they will never text you unless you have unlinked a card, used the Cash App card, have a scheduled deposit, or have an upcoming repayment from the loan you borrowed, but the hackers never tend to call you when you are being targeted.

“Send Me Money, I’ll Double It” Scheme

A particularly brazen scam involves promises of doubling your money. You may encounter social media posts or receive messages claiming that if you send a certain amount of money via Cash App, you’ll receive double in return. Of course, once you send the money, the scammer disappears, and you’re left with nothing.

Unfortunately, this scam doesn’t just end with you losing money. Many scammers access your contact list through Cash App and target your friends and family with the same promises of quick cash, turning them into victims as well.

Account Takeover and Contact List Hijacking

After successfully gaining access to your Cash App account, scammers often change your password to lock you out. From there, they can view your linked bank accounts and initiate unauthorized transactions. But the scamming doesn’t stop there—they also use your contact list to perpetuate the scam further.

The scammer sends fraudulent messages to your friends and family, often using your account to ask for money. Because the messages appear to be from someone the victims know (you), they’re more likely to fall for the scam. This can turn a single account takeover into a ripple effect, creating a chain of victims.

How to Recover After You’ve Been Hacked and Scammed

If you realize that you’ve been hacked and scammed through Cash App, quick action is essential to mitigate the damage. Here’s what you can do:

- Report the Fraud Immediately: Contact Cash App support as soon as possible to report the fraudulent activity. Please provide them with all relevant information, including unauthorized transactions and account changes.

- Change Your Passwords: If you can still access your account, change your password immediately. Also, consider changing passwords on any other accounts that use the exact login details.

- Alert Your Contacts: Let your friends and family know that your account has been hacked so they don’t fall victim to any requests for money sent by the scammers.

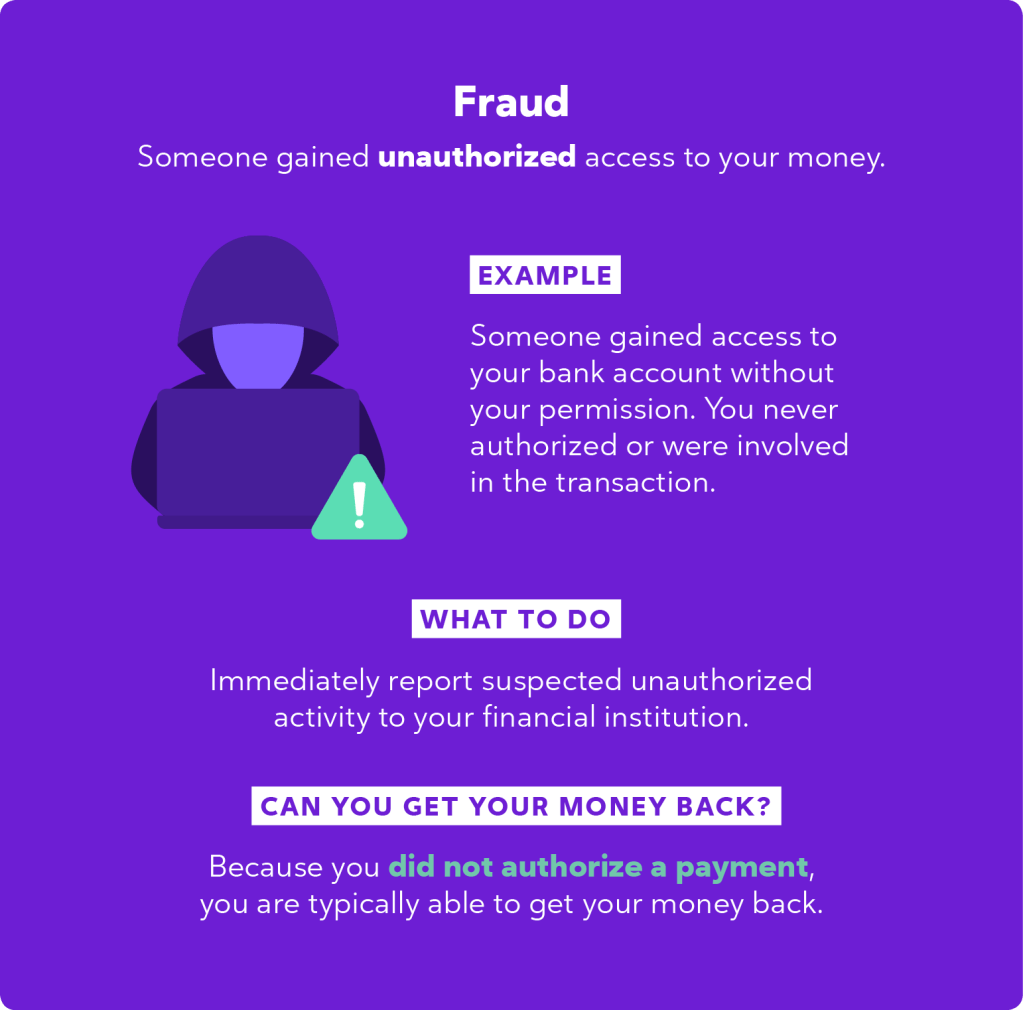

- Dispute Unauthorized Transactions: If scammers withdraw funds from your linked bank account or credit card, contact your financial institution to dispute the transactions and initiate any possible chargebacks.

- Monitor Your Accounts: Regularly check your bank statements and other accounts for any suspicious activity. Scammers may have tried to access more than just your Cash App account.

- Contact Authorities if Necessary: In cases of significant financial loss, it may be helpful to report the Fraud to the local authorities or federal agencies, such as the FTC or FBI.

How to Avoid Being Targeted Again

After recovering from a scam, the goal is to prevent it from happening again. Here are some steps to safeguard yourself from future hacking or scams:

Enable Two-Factor Authentication (2FA): Always enable 2FA on your Cash App and other financial accounts. This adds an extra layer of protection by requiring a code to be sent to your phone or email for every login attempt.

Be Wary of Unsolicited Requests: Whether through texts, emails, or social media, scammers often reach out under the guise of legitimate companies. Always verify the source of any communication before clicking links or providing personal information.

Don’t Share Sensitive Information: Scammers will try to trick you into giving up login details by pretending to be a legitimate service. Remember, no company will ask for your password or PIN via text or email.

Use Strong Passwords: Make sure your passwords are unique, strong, and regularly updated. Avoid using the same password for multiple accounts, especially for financial apps like Cash App.

Monitor Your Accounts Regularly: Frequently check your Cash App and bank accounts for any suspicious activity. The earlier you catch unauthorized transactions, the easier it will be to stop further damage.

Final Thoughts

As digital payment methods become more common, scams targeting them are on the rise as well. Scammers continually adapt their tactics, but by staying informed and alert, you can protect both your accounts and your contacts. Prioritize your financial security by keeping your information private, avoiding unknown links or offers, and promptly reporting any suspicious activity.

When I was scammed through Cash App, it was both frightening and frustrating, but it also served as a wake-up call. Scammers are getting more sophisticated, and their reach extends beyond just you—they can also target your contacts. Learning to recognize warning signs and acting fast if your account is compromised is crucial in today’s digital age.

The best approach is to stay cautious, verify unexpected messages, and use the highest level of security available for your financial accounts. While recovering from a scam is possible, prevention is far more effective. If you do fall victim to a scam, responding quickly will minimize the damage and better prepare you to avoid future incidents.

Stay safe, and help others stay safe, too!

Good article, hope you are doing well.

LikeLike

Great article, very informative. I can relate being a victim of fraud. Once by swiping at the gas pump and the other I’m still unsure about how it happened. But this article makes people aware and encourage people to stay safe. Great job.

LikeLike