So you think Life Insurance 🖋️📜is a good thing for your family once you have left this planet😵⚰️. You’d hoped that it would cover all your bills and leave a little something for your loved ones to get a leg up, but is it really a good thing to get🤷🏽♀️? Will it really take care of everything you need to have covered and paid💵? How can you be totally sure that it will pay out exactly what it needs to? Where do you begin on this financial journey, and how can you be sure that the agent you have trusted will do right by you?

It’s one thing to talk about Life Insurance with your friends and family. It’s another thing to speak with an agent and pick one out 🧑🏽. Although there are other ways to ensure your family’s financial security, is Life Insurance📜 a guaranteed structured way to get there? Can you borrow from your policy while you’re alive💸😌? How can you truly utilize your policy to the max to get the best out of your financial investment? Is it even considered as an investment, though🤔?

Life insurance, as a concept, has evolved from simple mutual aid societies of the ancient world to the complex financial instruments of today. Its history is not only about providing financial security but also reflects societal changes in understanding risk and valuing human life. This blog will explore the origins of life insurance, highlight its dual nature as both a lifesaver and a subject of controversy, and offer insights into its proper use and the dangers of fraud.

With that being said, turn off the TV📺. Don’t call your older brother or Mrs. Johnson, who is newly widowed, for the policy her husband purchased before he died⚰️, and do not call Cousin June Bug; he can’t even remember how many kids he got! Instead, let’s google that company and read some reviews. No, too much work; instead, you’d call Colonial Penn for a cheap policy? I see I have my work cut out for me. Well, Granny👵🏽, let’s start calling📱 around to see who can provide the best policy. Oh, yeah, make sure you leave everything to me )except the dog. I don’t like him like that😒) and leave out Aunt Barbara; she wants to sell the house!

Origins of Life Insurance

The concept of life insurance dates back to ancient civilizations, but it was not formalized as we know it today until much later. The earliest form of collective risk management, a precursor to insurance, was observed in the Code of Hammurabi around 1750 BC. However, the actual idea of life insurance began to take shape in Roman times with “burial clubs,” where people would contribute to a fund to pay for members’ funeral expenses and assist the family financially after death.

The more direct ancestor of modern life insurance is 17th-century England. The first documented life insurance policy was in London around 1583. However, the actual development came with the establishment of the Amicable Society for a Perpetual Assurance Office in 1706 by William Talbot and Sir Thomas Allen. This was the first company to offer a form of life insurance to the public.

Early Development and Pioneers

The first modern life insurance policy for which there is a detailed record was issued in 1583 to William Gibbons. The policy, underwritten by 16 associates, totaled £383. Unfortunately, the insurers refused to pay when Gibbons passed away within the policy term, leading to a landmark legal dispute that set a precedent for the necessity of clear, enforceable terms in insurance contracts.

The natural proliferation of life insurance came in the 1760s with the establishment of more sophisticated enterprises like The Society for Equitable Assurances on Lives and Survivorships in London. This entity introduced age-based premiums, making life insurance more accessible and systematically sound.

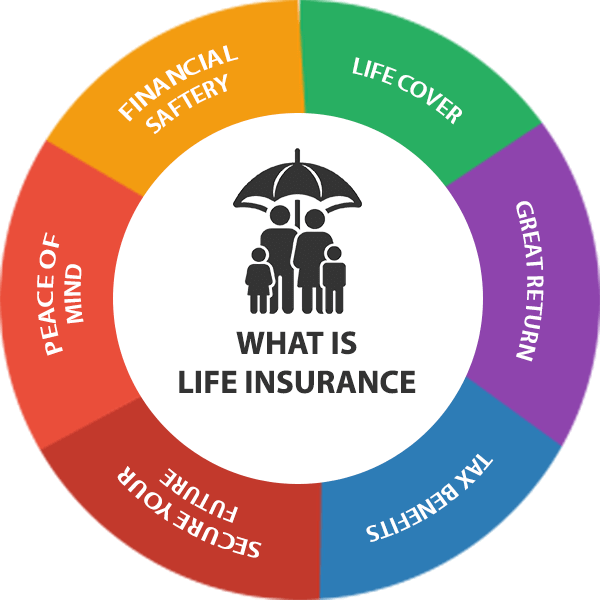

Criticisms and Misconceptions

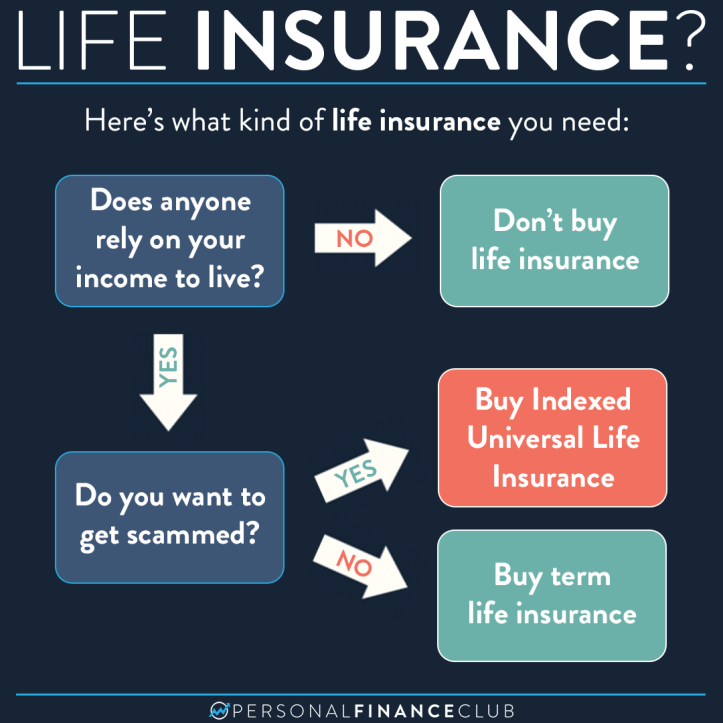

Life insurance has faced its share of skepticism and criticism, often branded as a “scam” by those who misunderstand its purpose and structure. The primary critique revolves around the idea that it is a good use of money if one does not die within the policy term or that it enriches insurance companies at the expense of the insured.

However, understanding the foundational principle of insurance—risk pooling—clarifies its legitimacy and utility. It’s a safeguard, not an investment. Each member of the insurance pool contributes premiums to a collective fund used to pay out claims as they arise under the law of large numbers.

Is Life Insurance Really a Lifesaver?

Life insurance policies have been instrumental in providing financial stability to families after the loss of a breadwinner. By paying a regular premium, policyholders ensure that their loved ones receive a sum of money upon their death, thereby helping them cover living expenses, debts, and plans like education. For many, it has been a critical component of financial planning and security.

Legal and Beneficial Use of Life Insurance

To use life insurance without falling into legal or ethical pitfalls, consider the following:

- Choose the Right Policy: Term insurance for temporary needs and whole life for permanent coverage.

- Be Honest: Always be truthful on your application to avoid the risk of fraud.

- Understand the Policy: Know what your policy covers and what it doesn’t to avoid surprises.

Versatile Uses of Life Insurance

Life insurance isn’t just about covering funeral expenses. It can be used in several strategic ways:

- Family Protection: To replace lost income and cover living expenses for your dependents.

- Debt Coverage: To cover outstanding debts, including mortgages, so they don’t burden your family.

- Estate Planning: Helps in tax planning and ensuring the smooth transfer of assets.

- Business Planning: This can be used in buy-sell agreements or to cover critical employees in a business.

Life Insurance Fraud: Just Don’t Do It

Life insurance fraud is a severe criminal offense that involves deliberately misrepresenting or withholding information to gain financial benefits from an insurance policy. This fraud can be committed in various ways. One standard method is by falsifying the insured’s health status or history to obtain lower premiums or to secure a policy that would otherwise not be granted. Another form involves the policyholder faking their own or another’s death to claim the death benefit. Such acts not only lead to legal penalties, including fines and imprisonment but also undermine the trust in which the insurance industry was built.

To avoid committing fraud, individuals must provide complete and accurate information during the application process. This includes disclosing all relevant medical conditions and lifestyle choices that could affect the policy. Policyholders should also regularly review and update their policies to reflect significant changes in their health or personal circumstances. Insurance companies have measures to detect and prevent fraud, such as requiring medical examinations, cross-checking application details with medical records, and investigating claims thoroughly before payouts are made. By adhering to honesty and transparency, individuals can uphold the integrity of their policies and avoid the severe consequences of fraudulent activities.

Selling your Life Insurance

Selling your life insurance can be a significant decision, often referred to as a life settlement. This process involves selling your existing life insurance policy to a third party, usually a life settlement company or investor, for a lump sum payment that is typically more than the policy’s cash surrender value but less than its death benefit. This option can provide immediate financial relief, especially for those facing unexpected medical expenses, significant debt, or need funds for retirement. By selling your policy, you can convert an intangible asset into cash, allowing you to address immediate financial needs or invest the proceeds elsewhere.

One of the primary benefits of selling your life insurance is the ability to access cash when it is most needed. For policyholders who no longer require life insurance coverage, perhaps because their beneficiaries are financially independent, a life settlement can be a practical solution. The lump sum received can be used to pay off debts, cover healthcare costs, fund long-term care, or simply enhance the quality of life during retirement. Moreover, it can be an attractive option for those who find it challenging to keep up with premium payments or whose policies are about to lapse or expire.

However, there are essential considerations when proceeding with a life settlement. The process involves fees and taxes that can reduce the net amount received. Additionally, selling your policy means your beneficiaries will no longer receive the death benefit, which could impact their financial security. It is crucial to consult with financial advisors or life settlement brokers who can provide guidance and ensure you receive a fair price for your policy. They can also help you understand the implications and explore alternative options that suit your financial goals and needs.

Practical Usage of Life Insurance

Today, life insurance serves various practical purposes, making it a crucial component of financial planning. Here are some critical uses:

- Financial Protection for Families: Life insurance ensures that dependents are financially supported in the event of the policyholder’s death. It can cover living expenses, education costs, and other essential needs.

- Debt Repayment: Life insurance can be used to pay off debts, such as mortgages, car loans, and credit card balances, preventing the burden from falling on surviving family members.

- Estate Planning: Life insurance can be a tool for estate planning, providing liquidity to pay estate taxes and other expenses and ensuring that the estate is preserved for heirs.

- Business Continuity: Life insurance can fund buy-sell agreements for business owners, ensuring the business can continue operating smoothly after a key person’s death.

- Supplementing Retirement Income: Certain life insurance policies, such as whole life and universal life, accumulate cash value over time. This cash value can be borrowed against or withdrawn, providing an additional source of income during retirement.

- Charitable Contributions: Policyholders can designate a charity as a beneficiary, ensuring that their philanthropic goals are met even after their passing.

Final Thoughts

Life insurance is a fundamental component of financial planning that provides peace of mind and economic security. Understanding its history, mechanics, and applications can empower consumers to make informed choices that align with their long-term financial goals. By debunking myths and approaching life insurance with knowledge and purpose, individuals can effectively use this tool to protect their loved ones and manage financial risks.

When used correctly, Life Insurance is a vital safety net. However, like any powerful tool, it must be handled with care, respect, and knowledge. Whether as a policyholder or a beneficiary, understanding the complexities and responsibilities of life insurance is crucial to maximizing its benefits while avoiding its potential pitfalls.

I actually learned something here. There any so many options available when it comes to insurance, it can overwhelming. But, I realize that we should all have some.

Thank you for sharing this information

LikeLike