“I need a quick way to flip this money. Know any good pyramids running?” ” Know anyone who can buss a lick? I need a quick come-up…..” Or how about the good ROSCA pot with some co-workers or the new Bitcoin flip?… If you have done any of these, my friend, you have been Ponzied. You have participated in a Ponzi Scheme and probably don’t even know it, and whether you did or didn’t, whether you were affected by the scheme or not, stealing someone else’s hard-earned money regardless of how much they have is Karma you really don’t want to collect.

You may have been tricked or knew what you were getting your money into. And chances are you’ve heard of a Ponzi Scheme. Whether you have been a victim or participated in one, you know what it’s all about. Whether you know it as a Pyramid Scheme (Most don’t consider this a Ponzi Scheme or even in the same category) or a Ponzi, it’s the worst way to get quick money. And if you have ever taken part in any of the following “Modern” schemes, you have contributed to someone else’s downfall, ‘Tisk Tisk’ on you.

The term “Ponzi Scheme” has become synonymous with financial fraud. It is named after Charles Ponzi, who duped thousands of investors in the early 20th century. This blog aims to inform and to get right into the scheme of things. We will learn the anatomy of a Ponzi scheme, explore its historical roots, and examine how it has evolved and manifested in contemporary society.

The Origin: Charles Ponzi and the First Scheme

Charles Ponzi, an Italian immigrant who became infamous for his namesake, was born in 1882 in Parma, Italy. Ponzi was brought up in a comfortable environment from a middle-class family, showing early signs of ambition and charm. His journey to America in 1903 marked the beginning of a tumultuous career. Initially, he struggled with various odd jobs, unable to find stable footing in the new world. Ponzi’s life took a pivotal turn when he discovered a loophole in the postal reply to a coupon system, which allowed him to exploit international currency exchange rates for profit.

This discovery laid the groundwork for the infamous “Ponzi scheme.” He promised investors outrageously high returns in a short period and initially paid these returns with money from newer investors rather than from any actual profit. This model of using new investors’ funds to pay earlier investors gave birth to one of the world’s oldest and most notorious financial frauds. His scheme eventually collapsed, causing financial ruin for many and cementing his name in history as a symbol of fraud and deception.

What you Need to know:

- *Charles Ponzi: An Italian immigrant in the U.S., Ponzi promised high returns from a postal reply to the coupon arbitrage scheme.

- **The Promise: Investors were pledged `to a 50% profit within 45 days or 100% within 90 days.

- ***The Reality: Ponzi paid earlier investors using newer investors’ capital rather than legitimate profits.

The Scheme’s Collapse

A Ponzi scheme collapses when it becomes unsustainable, often due to the inability to recruit enough new investors to pay earlier investors. This typically occurs in a rapidly escalating fashion. As the scheme unravels, the illusion of a high-return investment is shattered. The initiator of the scheme, who has often siphoned off a significant amount of the money, may attempt to vanish or be apprehended by authorities. Investors, many of whom have poured in their life savings, are left in financial ruin.

The fallout can be devastating:

Most participants lose their invested funds, and the scheme’s collapse erodes trust in legitimate investment opportunities. Additionally, the broader impact can be seen in the following regulatory and legal actions as authorities attempt to recover assets and prosecute fraudsters. The damage is not just monetary; the emotional and psychological toll on the victims can be profound, leading to strained relationships, tarnished reputations, and, in severe cases, even mental health crises. The Ponzi scheme’s implosion is a stark reminder of the risks of too-good-to-be-true investment opportunities and the importance of regulatory oversight in financial markets.

Charles Ponzi was eventually caught due to the unsustainable nature of his fraudulent investment scheme. As more investors were drawn to the high returns promised by Ponzi, the need for new capital to pay existing investors became critical. This cycle of using new investors’ money to pay earlier investors worked only as long as there was a steady influx of new funds. However, the scheme began to collapse when new investors’ flow slowed. Journalistic investigations, particularly by The Boston Post, raised suspicions about the legitimacy of Ponzi’s operations. These investigations and growing concern from financial authorities led to a closer examination of Ponzi’s accounts. It was soon discovered that he was not engaged in any legitimate profit-generating activity. The unraveling of this information led to Ponzi’s arrest in 1920, revealing the full extent of his fraudulent activities.

What you need to know:

- *Investigations and Exposure: The Boston Post began investigating Ponzi’s operations, leading to public skepticism and a run-on Ponzi’s company.

- **Bankruptcy: By August 1920, Ponzi was bankrupt, and his scheme had caused a loss of about $20 million.

Anatomy of a Ponzi Scheme:

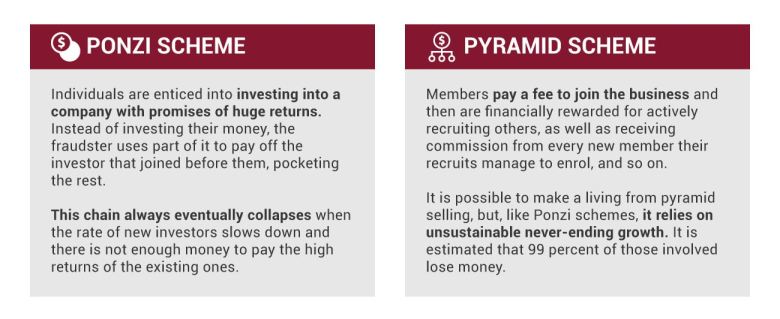

The Basic Structure

- The Setup: A fraudulent investment operation promising high returns with little or no risk.

- Initial Payouts: Early investors receive high returns, not from profit, but from new investors’ funds.

- Expansion: Rapid growth as initial success attracts more investors.

- Collapse: The scheme falls apart when it becomes impossible to recruit new investors or when many investors ask to cash out.

Key Characteristics

- Deceptive Returns: Returns are paid to early investors to create the illusion of a legitimate, profitable business.

- No Genuine Revenue: The scheme generates no significant revenue from business activities.

- Reliance on Recruitment: The scheme’s survival depends on constantly attracting new investors.

Evolution and Modern-Day Manifestations

Advancements in technology, especially the internet, have played a crucial role in this evolution. Online Ponzi schemes can reach a global audience, disguise themselves more effectively, and often involve intricate investment strategies or products to seem legitimate. Moreover, the rise of cryptocurrencies has given scammers new avenues to anonymize transactions and evade law enforcement. Thus, while the basic principle remains the same – using new investors’ money to pay earlier investors – the strategies and technologies used in Ponzi schemes have become increasingly sophisticated, making them harder to detect and dismantle.

So, you wanna do a ROSCA… Is it a Ponzi Scheme, though?

A ROSCA, or Rotating Savings and Credit Association, is a financial arrangement between individuals who agree to contribute a fixed amount of money regularly into a common fund. The fund is then given as a lump sum to a different group member at each meeting. This cycle continues until all members have received the lump sum once. ROSCAs are particularly popular in communities with limited access to formal banking services. They serve as an informal means of savings and credit, fostering mutual trust and financial discipline among members. The order in which members receive the lump sum can be determined by a lottery, bidding, or a pre-agreed sequence, offering financial support for personal or business needs.

Technological Advancement and Global Reach

The Ponzi scheme has evolved significantly with technological advancements and global reach in modern times. Initially characterized by promising high returns with minor risk, Ponzi schemes traditionally relied on simple word-of-mouth and paper-based communications. However, the internet and digital technologies have transformed into more sophisticated frauds. Today, they leverage digital platforms, social media, and even cryptocurrencies to target a global audience.

The anonymity and borderless nature of digital transactions make it easier for fraudsters to conceal their identities and operations while reaching potential victims worldwide. This global reach is further bolstered by the ability to create convincing online presences, complete with fake reviews and testimonials. The combination of technology and global connectivity has expanded the scale of Ponzi schemes and made them more challenging for authorities to detect and dismantle. This evolution highlights a critical need for increased public awareness and robust regulatory measures to combat these modernized financial swindles.

What to Know:

- Online Platforms: The internet has enabled schemes to reach a global audience.

- Cryptocurrency: New Ponzi schemes often involve cryptocurrency, exploiting this sector’s lack of understanding and regulation.

Notable Modern Examples

Some notable modern examples of individuals who became widely known for their involvement in Ponzi schemes include:

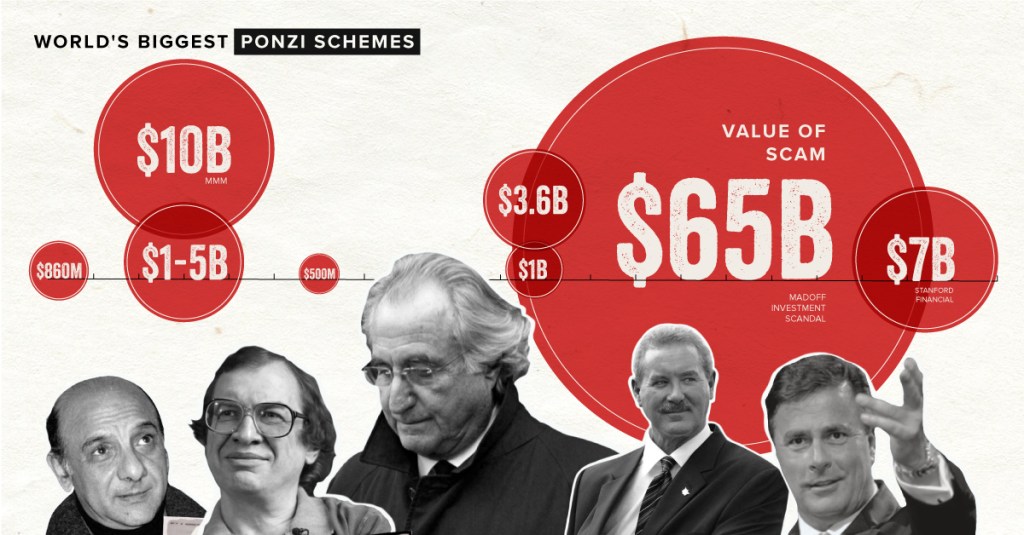

- Bernie Madoff: Perhaps the most infamous Ponzi Scheme in recent history, Bernie Madoff was responsible for running the largest Ponzi scheme ever, with estimated losses of around $65 billion. His scheme, uncovered in 2008, affected thousands of investors, including individuals, charities, and institutions.

- Allen Stanford: He was convicted in 2012 for a Ponzi scheme that amounted to about $7 billion. Stanford’s scheme involved selling fraudulent certificates of deposit from his offshore bank in Antigua.

- Scott Rothstein: A former lawyer in Florida, Rothstein ran a Ponzi scheme that sold fraudulent settlements in legal cases. His scheme was estimated to be around $1.2 billion.

- Tom Petters was found guilty of running a $3.65 billion Ponzi scheme in 2009. Petters’ scheme involved purportedly purchasing electronics to sell to big-box retailers, but the sales were fictional.

- Lou Pearlman: Known for his involvement in the music industry, Pearlman was also responsible for running a long-term Ponzi scheme. He defrauded investors out of more than $300 million.

These individuals gained notoriety for the scale and impact of their fraudulent activities, highlighting the risks and consequences of such financial schemes.

BitCoin The New Ponzi?

Some critics have often compared Bitcoin, a digital cryptocurrency, to a Ponzi scheme. A Ponzi scheme is a fraudulent investment fraud that promises high returns with minor risk to investors. The scheme generates returns for older investors by acquiring new investors. This is similar to a pyramid scheme in that both are based on using new investors’ funds to pay the earlier backers.

Critics argue that Bitcoin resembles a Ponzi scheme due to its reliance on increasing prices and the influx of new buyers to remain viable. They claim that early adopters profit at the expense of those who invest later. However, supporters of Bitcoin argue that it is a legitimate financial innovation and investment asset with intrinsic value and potential for broad adoption, differing fundamentally from a Ponzi scheme. As with any investment, potential Bitcoin investors are advised to exercise caution and do their due diligence.

What To Know:

- Bernie Madoff’s Ponzi Scheme: Arrested in 2008 for running a scheme that defrauded investors of approximately $65 billion.

- Cryptocurrency Schemes: Examples include Bitconnect and OneCoin, masquerading as legitimate cryptocurrency investment

Social and Economic Impact

Economically, the Ponzi schemes lead to substantial financial losses for investors, often wiping out life savings and undermining trust in legitimate investment opportunities. Socially, the repercussions are equally profound. Victims of Ponzi schemes suffer from a sense of betrayal and emotional distress, which can lead to broader societal mistrust. Moreover, the publicity surrounding such schemes highlights vulnerabilities in financial regulatory systems, prompting calls for stricter oversight and consumer protection. The enduring legacy of Ponzi schemes serves as a cautionary tale about the perils of greed and the importance of due diligence in financial endeavors.

What to Know:

Individual and Societal Losses

- Financial Ruin for Investors: Many lose their savings, leading to severe personal and family crises.

- Broader Economic Implications: Large-scale schemes can have ripple effects on the financial system and investor confidence.

Regulatory Responses

Regulatory responses to the Ponzi scheme phenomenon have significantly evolved, particularly following high-profile cases like that of Bernie Madoff. These responses typically focus on strengthening investor protection, enhancing transparency, and imposing stricter penalties for fraud. Key measures include:

- Rigorous enforcement of existing securities laws.

- Improved auditing and reporting standards for investment firms.

- The introduction of more robust due diligence requirements for brokers and financial advisors.

Additionally, regulatory bodies like the SEC in the United States have increased their surveillance and investigation capabilities to detect such schemes early. Educational campaigns aimed at investors, highlighting the signs of Ponzi schemes and the importance of diversification in investments, also play a crucial role. These measures aim to create a more secure financial environment and restore investor confidence.

What to Know:

- Increased Scrutiny: Regulatory bodies like the SEC have heightened their focus on investment schemes.

- Educational Campaigns: Efforts to educate the public about investment fraud and warning signs.

Final Thoughts

The Ponzi scheme, a century-old fraud model, continues to adapt and thrive in new guises. Its evolution, fueled by technological advancements and the allure of easy profits, is a cautionary tale for investors. The key to combating these schemes lies in awareness, regulatory vigilance, and skepticism toward investments that seem too good to be true. As the financial landscape evolves, so must our collective vigilance against these timeless scams. The Ponzi scheme remains a cautionary tale in the financial world, still relevant and mimicked in various forms.

I was defrauded of $78,000 by an individual I met online who was involved in a fraudulent investment endeavour. I initiated a search for legal assistance to retrieve my funds, and I encountered numerous testimonies regarding a criminal named ExpressHacker99. I contacted them and provided the requisite information. The experts were able to locate and assist in the recovery of my misappropriated funds within approximately 36 hours. The fraudster was apprehended and apprehended by local authorities in his region, which is a source of immense relief for me. I trust that this information will be beneficial to the numerous individuals who have fallen victim to these fraudulent online investment scams. Their professional services are highly recommended for those in need of prompt and effective recovery assistance. If you require their services, you may only contact them via email at ExpressHacker99[at]gmail[dot]com.

LikeLike