We all have seen them on the television; whether late at night or early in the morning, they are there. While we get ready for work or school, they would tell us how they are there to get us out of the financial run we are in. Those terribly acted commercials about getting cash from those “easy cash solution” stores. You know, Amscot, Check Cashing America, and other infamous places. They promise an easy solution to your need for cash and access to extra funds from your local bank. But what is going on here? Already knowing the risks and the endless loop you’ll be stuck in should you get one. These short-term solutions immediately relieve your “I need money now” problem.

Why are they so tempting to do? Why ignore the red flags and caution signs they come with to get them? Why are there no credit checks, and why is choosing not to pay them back the only solution to getting out of the loop? How is it that they are the ONLY option to turn to when we are in a financial bind? Getting a small personal loan is extremely hard; these loans were created to keep us in some form of financial debt to keep us stuck and relying on them.

They have the requirements to get one so simple and easy that you need to read the fine print. You never ask questions about the interest rate(s), and you never seem to care about anything except getting the extra funds you lack. Whether it’s our fault for the neglect or maybe it’s the relief of a solution that gets us in trouble with negating the results of getting the loan. No matter your reasoning for getting it in the first place, you are responsible for repaying it promptly and in whole or else……

By now, you already know I’m not anything professional. I’m no expert, and I cannot make your life magically happier, nor can I take away all of your bad experiences and find a magical loophole where you will get revenge against all those who have wronged you. But I can open up your mind and get you to think about being better to yourself and much kinder, too. In this blog, I will take you down the financial rabbit hole of the diabolical payday loan. We will examine the risk of the interest you are being charged and why you can never sever that cord to them even if you manage to repay them and come out unscathed. So, grab your wallets and coin purses, our checkbooks (you can’t get a payday loan without a blank check… Ever wonder why?), and three current copies of your bank statements. As we fall down the rabbit hole, we might come across Alice, the money thief of What a Bummer Land, and her band of payday loan bandits. Oh, and watch out for the Red Queen…… She keeps your bank account in the red…… wink-wink.

The Emergence of Payday Loans

The emergence of payday loans represents a significant development in consumer finance, mainly catering to those needing immediate financial assistance. Originating in the United States in the early 1990s, payday loans grew out of a need for accessible short-term credit options for individuals outside traditional banking services due to low incomes or poor credit histories. These loans are typically small, high-interest, short-term loans intended to cover a borrower’s expenses until their next payday.

The process is straightforward: borrowers provide lenders with a post-dated check or electronic access to their bank account as security for the loan. The appeal of payday loans lies in their minimal eligibility requirements, which often disregard credit history in favor of proof of regular income, thereby providing a financial lifeline to those who might otherwise be excluded from conventional lending options.

However, this convenience comes at a high cost. Payday loans are notorious for their exorbitant interest rates and fees, which can lead to a debt cycle for borrowers who need help to repay the loan promptly. This aspect has sparked significant controversy and criticism, leading to calls for stricter industry regulation. Some critics argue that payday loans exploit vulnerable populations by trapping them in an endless cycle of debt. At the same time, proponents contend they offer a necessary service for individuals who need financial recourse.

Over the years, various states and countries have implemented regulations to cap interest rates and fees. However, the industry thrives due to the persistent demand for short-term, accessible loans. The evolution of payday loans reflects a broader trend towards more diverse and accessible financial services, albeit accompanied by ongoing debates about consumer protection and financial responsibility.

How Payday Loans Work

Payday loans are characterized by their small amounts and short repayment terms. Here’s how they typically operate:

Loan Amount and Approval: Borrowers receive a small sum, usually a few hundred dollars.

Short-term Agreement: The loan is due by the borrower’s next payday, typically within two weeks to a month.

High-Interest Rates: These loans come with extraordinarily high annual percentage rates (APRs), often exceeding 300%.

Repayment Method: Borrowers provide a post-dated check or authorize an electronic withdrawal from their bank account for repayment.

The Payday Loan Cycle

These short-term loans come with exorbitantly high-interest rates, making them significantly more expensive than conventional loans. When a borrower takes out a payday loan, they are typically required to repay it by their next payday. However, due to the steep interest fees, many borrowers need more time to repay the total amount. This leads to rolling over the loan, incurring additional fees and interest, often escalating the debt further. The cycle continues with each payday, as borrowers get entangled in a loop of taking new payday loans to pay off the previous ones, perpetually struggling under the burden of accumulating debt and soaring interest rates…

Why Payday Loans Are Considered Predatory

Payday loans are often considered predatory due to several inherent features that can create a cycle of debt for consumers. Firstly, they are characterized by high interest rates compared to traditional loans, often reaching an annual percentage rate (APR) of 300% to 500%. This exorbitant cost makes it challenging for borrowers to repay the loan and meet their regular financial obligations. Secondly, payday loans typically require full repayment within a short period, usually two weeks or by the next payday. This is a problematic timeline for borrowers already in a financial crunch.

This short repayment period often forces borrowers to renew or roll over their loans into new ones, incurring additional fees and interest, leading to a debt spiral. Thirdly, payday lenders are known to employ aggressive collection practices, further exacerbating the financial stress on borrowers. Moreover, payday loans are frequently targeted toward vulnerable populations, such as low-income individuals and communities, who may need access to traditional banking services or credit. This targeting can exploit the financial desperation of these groups, trapping them in a cycle of debt and financial instability.

In summary, they have exorbitant interest rates, short repayment periods, predatory lending practices, and targeting vulnerable populations, making payday loans highly contentious and predatory.

What to Know:

Exorbitant Interest Rates: The high APRs can turn a small loan into a significant financial burden.

Debt Cycle: The structure of these loans often traps borrowers in a cycle of debt.

Targeting Vulnerable Populations: Payday lenders typically target low-income communities and those with limited access to traditional banking.

Lack of Transparency: More transparent information about the actual loan cost is needed.

Recognizing When to Walk Away from Payday Loans

Recognizing when to walk away from payday loans is crucial for maintaining financial health and avoiding a cycle of debt. Payday loans, often characterized by their high-interest rates and short-term nature, are a quick fix for immediate cash needs. However, their excessive costs can trap borrowers in a relentless cycle of debt. Walking away when these loans threaten to compound existing financial difficulties rather than resolve them is essential. Red flags include the need to repeatedly roll over the loan, which amplifies the financial burden due to additional fees and interest charges. When the cost of borrowing significantly outweighs the temporary relief it provides, it’s a clear indication to explore alternatives.

Other signs include a consistent reliance on payday loans to meet regular expenses, which signals a deeper financial issue that payday loans cannot address. In these situations, seeking advice from a financial counselor, exploring community assistance programs, or discussing longer-term, lower-interest loan options with a bank or credit union can be a more sustainable approach to managing financial challenges. Recognizing these warning signs and resisting the allure of a quick payday loan can save individuals from spiraling into a more profound financial crisis.

What To Know:

Alternatives Available: If other options like personal loans, credit card advances, or borrowing from friends and family are available, they are usually more financially sound.

Inability to Break the Cycle: If you repeatedly take out payday loans to cover the last one, it’s a clear sign that it’s time to seek alternatives.

Long-term Financial Harm: Recognize when the loan is causing more harm than good to your financial situation.

Strategies To Break the Cycle

- Assess Your Financial Situation: Begin by clearly understanding your financial position. List all debts, including payday loans, and compare them with your income and essential expenses.

- Create a Budget: Develop a budget that prioritizes critical expenses. Identify areas where you can cut costs to free up money for loan repayment.

- Negotiate with lenders: Contact your payday loan lender and discuss your difficulty repaying the loan. Many lenders are willing to negotiate repayment plans, extend the loan term, or reduce the interest rate.

- Seek Alternative Financing Options: Consider personal loans from banks or credit unions, which usually have lower interest rates and longer repayment terms than payday loans. Even borrowing from friends or family can be a more viable option.

- Build an Emergency Fund: Once you pay off the payday loan, start building an emergency fund. Even a tiny fund can help cover unexpected expenses without needing high-interest loans.

- Consider Credit Counseling: Non-profit credit counseling agencies can guide debt management budgeting and even negotiate with lenders on your behalf.

Dealing with Excessive Loan Cost

If you find that you’re paying more than you should on a payday loan:

- Review Loan Agreements: Carefully examine the terms and conditions of your loan agreement. Be aware of the interest rate, fees, and the total amount repayable.

- Check for Legal Compliance: Ensure that your lender follows state regulations regarding payday loans. Some states have caps on interest rates and fees.

- Report Violations: If your lender is not compliant with state laws, report them to the state attorney general or the Consumer Financial Protection Bureau.

- Seek Legal Advice: If you suspect illegal practices or are overwhelmed by the complexity of your situation, consider seeking advice from a consumer rights attorney or a legal aid organization.

Why You can’t have two at once:

Having two payday loans at once is generally prohibited because it can lead to a dangerous cycle of debt. Payday loans are known for their high-interest rates and high-interest nature, designed to be a quick fix for immediate financial needs. When a person takes out a payday loan, they are typically required to repay it by their next payday, usually within two to four weeks. Allowing borrowers to take out multiple payday loans simultaneously would increase the risk of them falling into a debt trap, where they cannot repay and continuously borrow to cover previous loans.

This can lead to escalating fees and interest, making it even more challenging to break free from debt. To prevent this, the system is designed to limit individual limits loans simultaneously, ensuring they can handle multiple high-cost loans and the accompanying financial stress. Additionally, payday lenders often use centralized tracking systems to check whether a borrower already has an outstanding payday loan, further enforcing this one-loan policy.

Installment Loans, like, are you serious?

Installment loans are a type of loan where the borrower repays the loan amount, interest, and a series of scheduled payments over a set period. The concept of installment loans dates back to the late 19th century, emerging as a response to the need for consumer credit in a rapidly industrializing society. Unlike payday loans, which require a lump sum repayment, installment loans are structured to be paid back in smaller, more manageable amounts. Initially, installment loans were created to help consumers afford big-ticket items that were out of reach, such as furniture or household appliances, by spreading the cost over time. This form of credit was revolutionary, enabling people to access essential goods and improve their living standards without the immediate financial burden.

However, despite their apparent convenience, installment loans can be risky for financial aid. One of the main issues is the high interest rates and fees that interest these loans, which can be significantly higher than traditional bank loans. This makes them an expensive form of borrowing, especially for those who are perennially vulnerable. Moreover, the structure of installment loans can create a cycle of debt. Borrowers who cannot make timely payments may face additional fees or refinancing options extending the loan term, ultimately increasing the total amount owed. This cycle can be hard to break and complex to long-term financial difficulties.

Furthermore, the ease of access to installment loans has led to a rise in predatory lending practices. Some lenders target low-income consumers or those with poor credit histories, offering loans with terms that are difficult to meet and leading to a trap of continuous borrowing and escalating debt. While installment loans were created to provide purchase goods through manageable payments, their high costs, the potential for leading to a debt cycle, and association with predatory lending practices make them a questionable choice for financial assistance, especially for vulnerable consumers.

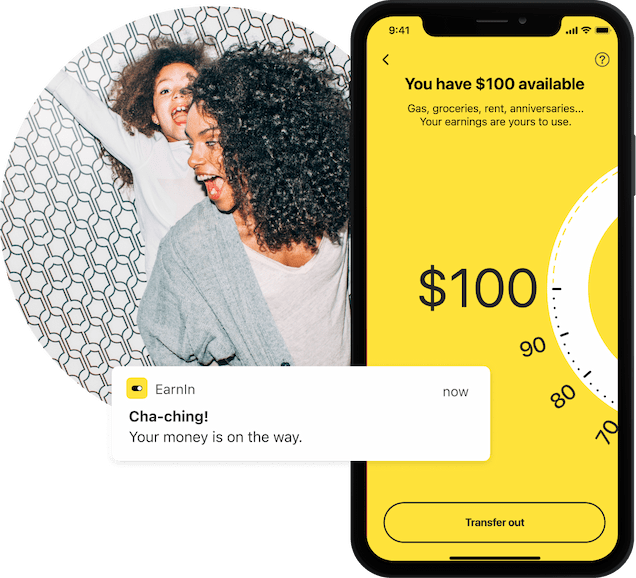

Payday Loan Apps: The New Instant Loan

ERRIN, ROCKEY MONEY, DAVE, CHIME, VARO, and CASHAPP are financial apps that offer short-term cash advances, often seen as payday loans in a smaller and more convenient form. While these apps may market themselves as providing quick access to funds in times of need, they can sometimes trap users in a cycle of borrowing. They offer these advances at lower interest rates, making it seem cost-effective.

However, as users continue to borrow from these apps, they may not realize that the fees and interest can accumulate, making it harder to break free from the cycle of debt. It’s crucial for individuals to carefully consider the terms and expenses associated with these services and to use them judiciously to avoid falling into a cycle of continuous borrowing.

Final Thoughts

While payday loans might seem convenient for immediate cash needs, their long-term impact can be detrimental. It is crucial to understand their mechanics. Understand their mechanics and recognize and seek health-knowledgeable financial alternatives. Seeking advice from crucial financial counselors and exploring other lending options can prevent the cycle of debt that payday loans often perpetuate.

Escaping the payday loan cycle requires careful financial planning, exploring alternative credit sources, and being proactive about your rights as a borrower. By implementing these strategies, you can move towards financial freedom and avoid the pitfalls of high-cost, short-term lending. Remember, while payday loans offer a quick fix, the long-term solution lies in sound financial management and building a solid foundation for your economic future.

So the next time you are in a financial bind and need cash instantly, you may want to think about the financial cycle you will be getting into should you decide to go down the rabbit hole of the Payday Loan…… oh and stay away from Alice and those bandits of thieves they work for the Red Queen. If you can’t, they will rob you blind… like seriously, you will never have any money messing with them, and you will forever be stuck in the Payday Twilight Zone…..