Income tax is essential to every citizen’s financial responsibility, contributing to developing and maintaining a country’s infrastructure, services, and social programs. Understanding how the income tax process works, from filing your taxes to receiving your return, empowers individuals to manage their finances effectively. In this comprehensive guide, we’ll take you through the stages of this journey, shedding light on each step to help demystify the income tax process.

Paying income taxes has existed for over a century, but receiving a refund for overpaying taxes is relatively recent. The origins of the income tax refund can be traced back to World War I, when the government needed to raise funds to support the war effort. The income tax was introduced as a temporary measure but became a permanent fixture in the U.S. tax system.

The concept of taxing individuals based on their income can be traced back to ancient civilizations. In various forms, taxes have been levied on individuals and their possessions throughout history. However, the modern income tax system, as we know it today, emerged in the late 18th and early 19th centuries.

In the United States, the implementation of income tax can be attributed to the passage of the 16th Amendment to the U.S. Constitution in 1913. Before that, the federal government primarily relied on tariffs and excise taxes to generate revenue. However, the 16th Amendment granted Congress the power to impose and collect taxes on incomes without apportionment among the states.

Initially, the government collected taxes in full at the end of the year, and if a taxpayer had overpaid, they were given a credit to use in the following year. However, it was in the mid-1930s that the government started offering refunds to taxpayers who had overpaid on their taxes. This was seen as a way to stimulate the country economically during the Great Depression.

In the past, income tax rates were relatively modest, with the top marginal rate set at 7% for individuals. However, over the years, as the government’s responsibilities and expenses increased, income tax rates were adjusted accordingly. For example, income tax rates surged significantly during World War II to finance the war efforts.

Refund checks’ introduction can be linked to the progressive nature of income tax. The progressive tax system means that higher-income individuals pay more of their earnings as taxes. Refund checks, also known as tax refunds, were devised to ensure that the tax burden is fair and not overly burdensome for lower-income individuals.

A tax refund occurs when an individual has paid more in taxes throughout the year than they owe. This excess amount is refunded to the taxpayer by the government. Refund checks provide a mechanism for returning the overpayment and offering financial relief to individuals who have had more taxes withheld from their income than necessary.

The refund process typically involves individuals filing their tax returns and accurately reporting their income, deductions, and credits. After reviewing the returns, the tax authorities calculate the actual tax liability. If the amount paid exceeds the actual liability, a refund check is issued to the taxpayer.

Filing Your Taxes, The Starting Line

Filing your income tax return marks the beginning of your tax journey. Typically, the tax year corresponds with the calendar year, and taxpayers must file their returns by a specific deadline, often around April 15th. However, these deadlines can vary depending on your country’s tax laws.

- Gathering Documents: To accurately report your income and claim deductions, you’ll need essential documents like W-2 forms (or equivalent), 1099 forms, and any other relevant financial statements.

- Choosing the Right Form: The type of form you need to complete depends on your financial situation. Common forms include 1040, 1040A, and 1040EZ. More complex scenarios may require additional forms and schedules.

- Reporting Income and Deductions: When filling out your tax return, you’ll report all sources of income, including wages, self-employment income, interest, dividends, and more. You’ll also deduct eligible expenses, credits, and deductions to reduce your taxable income.

- Filing Methods: Taxpayers can file their returns electronically through tax software or online platforms or opt for traditional paper filing. Electronic filing often results in faster processing and reduces the likelihood of errors.

Over time, the complexity of tax laws and the intricacies of individual financial situations have made tax refunds a crucial component of the income tax system. They serve not only as a mechanism for returning overpaid taxes but also as an opportunity for individuals to correct errors, claim eligible credits, and adjust their overall tax liability.

Today, income tax and the issuance of refund checks play integral roles in the fiscal operations of many countries worldwide. They form the backbone of government revenue collection and enable the redistribution of wealth through progressive tax structures, ensuring that the burden of taxation is distributed equitably.

The process of receiving an income tax refund was made more accessible with the W-2 form, which showed the amount of taxes withheld from an individual’s paychecks throughout the year. This made it easier for taxpayers to determine if they had overpaid and were entitled to a refund.

Over the years, the income tax refund has become essential to many people’s financial plans. Many individuals rely on tax refunds to pay bills, make large purchases, or save for the future. In recent years, the government has encouraged taxpayers to have their refunds directly deposited into their bank accounts, making receiving a refund faster and more convenient.

Processing Your Tax Return Behind the Scenes

Once you’ve filed your tax return, it enters the processing phase, during which tax authorities review the information you’ve provided and perform various checks to ensure accuracy.

- Initial Review: Tax agencies perform an initial review to check for basic errors or inconsistencies. If discrepancies are found, you may receive a request for clarification or additional documentation.

- Matching Data: Tax agencies cross-reference the information you provided with data from your employers, financial institutions, and other sources to ensure accuracy. This helps identify unreported income or other discrepancies.

- Automated Algorithms: Sophisticated algorithms identify patterns and anomalies that may indicate errors or potential fraud. If flagged, your return might undergo further scrutiny.

- Manual Review: Some returns are selected for manual review by tax professionals. This could be due to complex deductions, credits, or other factors that require a closer look.

Income tax refund has a long and exciting history that has evolved to serve taxpayers’ needs better. Today, it is an integral part of many people’s financial planning, and the government continues to make changes to make the process of receiving a refund as convenient as possible.

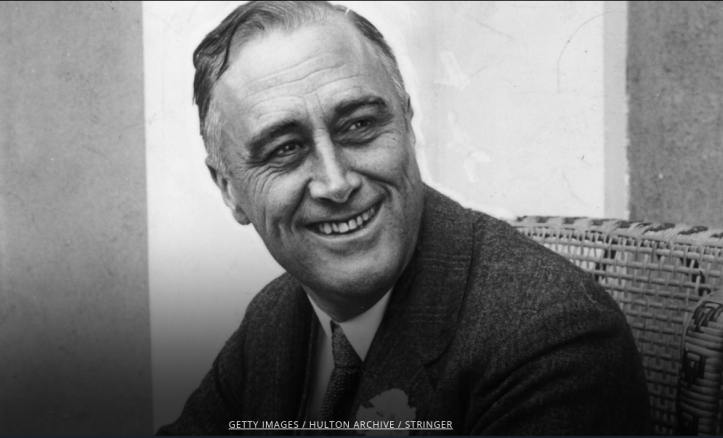

FDR’s Innovative Approach- The First Income Tax Refund and its Impact on the U.S. Economy during the Great Depression

The Great Depression of the 1930s is one of American history’s most challenging and transformative periods. As the nation grappled with unprecedented economic hardship, President Franklin D. Roosevelt (FDR) emerged as a visionary leader, implementing groundbreaking policies to alleviate the suffering and rejuvenate the faltering economy. Among his notable contributions was the introduction of the first income tax refund. This measure immediately relieved struggling Americans and laid the groundwork for long-term economic recovery.

The Economic Landscape of the Great Depression: When Franklin D. Roosevelt assumed office in 1933, the United States was in a severe economic crisis. Unemployment had soared to unprecedented levels, businesses collapsing, and families struggled to make ends meet. Conventional economic policies had proven ineffective in stemming the tide of devastation, prompting FDR to adopt innovative and bold strategies.

The Genesis of the First Income Tax Refund: One of FDR’s most innovative measures was the introduction of the first income tax refund. This policy aimed to provide financial relief to individuals and families burdened by the economic turmoil. Enacted as part of the Revenue Act of 1936, the refund mechanism allowed taxpayers to receive a portion of their income tax payments back from the government. This marked a departure from the previous systems where taxes were collected without immediate consideration for the economic well-being of citizens.

Immediate Relief and Consumer Spending: The first income tax refund injected much-needed liquidity into households nationwide. By putting money directly into the hands of consumers, FDR’s policy encouraged increased spending on goods and services. This surge in consumer activity stimulated demand, bolstered business revenues, and ultimately contributed to creating and preserving jobs. The influx of cash into the economy acted as a catalyst, setting in motion a cycle of economic recovery that had been elusive for years.

Setting the Stage for Economic Recovery: Beyond its immediate impact, introducing the first income tax refund set a precedent for future economic policies. FDR’s willingness to experiment with novel ideas demonstrated a government’s capacity to intervene in the economy to address crises. This approach laid the foundation for subsequent initiatives aimed at regulating financial markets, instituting social safety nets, and fostering a more equitable distribution of wealth.

Franklin D. Roosevelt’s decision to implement the first income tax refund during the Great Depression marked a pivotal moment in American history. This policy provided vital relief to struggling individuals and families and played a crucial role in jump-starting the economy’s long road to recovery. By channeling funds directly into the hands of consumers, FDR’s innovative approach helped restore consumer confidence, stimulate spending, and reignite economic growth. Furthermore, this policy’s legacy endured in the form of subsequent government interventions that aimed to safeguard the well-being of citizens and promote economic stability.

The Consequences of Avoiding Income Tax Filing

and Income Tax Fraud

Income tax is an essential aspect of modern society, serving as a primary source of revenue for governments worldwide. Filing income taxes accurately and honestly is a legal obligation and contributes to the smooth functioning of government programs and services. However, some individuals may be tempted to evade their tax obligations by failing to file taxes or committing income tax fraud. This blog post will explore the repercussions of avoiding income tax and shed light on the consequences of non-filing and tax fraud.

Non-Filing of Income Taxes

Failing to file income tax returns is a serious offense that can result in various negative consequences. For example, this can affect your overall return amount and cost you years of having your return check recouped by the IRS. In addition, it never pays to avoid your responsibility as a U.S. citizen. Still, when you don’t file your income taxes, you keep vital funds from coming to your local area to help your local governments help keep your towns and cities repaired and cleaned. The results of not filing your taxes are:

- Late Filing Penalties- If you do not file your income taxes by the designated deadline, typically April 15th, in the United States, you may incur significant penalties. These penalties can accumulate over time, resulting in a substantial financial burden.

- Interest and Accumulated Debt- The longer you delay filing your income taxes, the more interest and penalties will accrue on the amount owed. This can lead to a significant debt that may be difficult to manage in the long run.

- Loss of Refunds and Credits- Please file taxes to ensure you can claim any tax refunds or credits you may be entitled to. This means you would miss out on potential financial benefits that could have been utilized to improve your financial situation.

- Legal Consequences- Many jurisdictions consider Non-filing income taxes a criminal offense. While the severity of penalties may vary depending on the circumstances and jurisdiction, you may face fines, liens, or even imprisonment for persistent non-compliance.

Income Tax Fraud and its Consequences.

Income tax fraud involves intentionally providing false or misleading information on tax returns to evade paying the accurate amount of taxes owed. For example, some lie about how many children they care for or how much money they lack. Some have also filed someone else’s taxes that aren’t their own. Either way, they are on a path to prison for Income Tax Fraud. Here are some critical points to understand about Income Tax Fraud:

- Criminal Offense- Income tax fraud is a serious crime with severe legal consequences. If caught, you may face criminal charges, fines, and imprisonment, depending on the jurisdiction and the magnitude of the fraud committed.

- Audit and Investigation- Tax authorities have robust systems to detect fraudulent activities. Suspicious or inconsistent information on tax returns can trigger audits and investigations. These processes can be invasive, time-consuming, and require substantial documentation to support your claims.

- Financial Penalties and Liabilities- Income tax fraud can result in substantial financial penalties besides legal repercussions. The penalties may exceed the amount of tax evaded and can significantly impact your financial stability.

- Damage to Reputation and Trust- Committing income tax fraud can have long-lasting consequences beyond legal and financial ramifications. Your reputation and trustworthiness may suffer, affecting your personal and professional relationships. It can also impact future opportunities such as obtaining loans, employment, or business partnerships.

Avoiding income tax obligations through non-filing or committing tax fraud is risky and ill-advised. The consequences can range from financial penalties and accumulated debt to legal troubles and damaged reputation. Therefore, it is crucial to fulfill your tax obligations accurately and honestly, not only to comply with the law but also to contribute to the welfare of society. Remember, seeking professional advice from qualified tax professionals can help you meet your tax obligations while optimizing your financial situation within legal boundaries. It is always better to be proactive and responsible when filing income taxes, ensuring compliance and peace of mind in the long run.

Navigating the income tax process, from filing to processing to receiving your return, is a significant financial undertaking requiring attention to detail and understanding the steps involved. By gathering accurate information, filing your taxes correctly, and staying informed about the processing timeline, you can maximize your chances of receiving a timely and accurate tax refund. Remember that tax laws and regulations can evolve, so it’s wise to stay updated on any changes that may impact your tax situation. Ultimately, completing this journey contributes to your financial well-being and the functioning of essential public services that benefit us all.